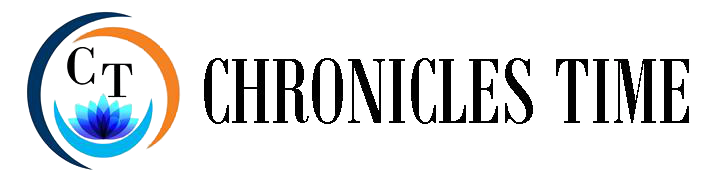

Logging in to the OCBC Mobile Banking app via the SingPass app.

SINGAPORE: OCBC customers can now use their SingPass to log in to their accounts with the bank, the lender said on Thursday (Jul 16).

This comes after OCBC rolled out the use of SingPass Mobile app on Jul 4 as an alternative login to access its digital bank services.

The bank said that it is the first lender in Singapore to enable the use of SingPass for digital banking services. It can be used to log in to OCBC’s Mobile Banking app or Internet banking.

In a media release, the bank said the use of SingPass to log in to OCBC’s digital banking platforms eliminates the need for customers to remember multiple access codes and PINs. This will “especially benefit” customers who do not use fingerprint or facial biometrics, it said.

OCBC said it has 1.8 million digital customers.

HOW IT WORKS

To use the service, customers must have the SingPass app on their phones.

Click on “SingPass Login” on OCBC’s Internet banking login screen, or “Login with SingPass Mobile” on the bank’s mobile app.

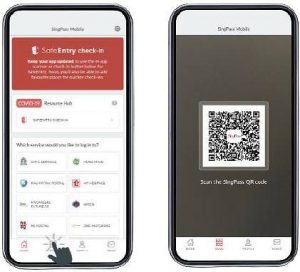

Those using OCBC’s Internet banking service on a desktop should then open the SingPass app on their mobile device, tap on the scan icon and scan the QR code displayed on the desktop screen.

Mobile banking users can tap on the SingPass Mobile QR code that appears on the OCBC app.

Users will be able to access the digital banking services once their identity is authenticated.

The OCBC Internet banking interface.

The SingPass app interface.

OCBC said digital transactions among its customers have surged amid the COVID-19 pandemic, with close to 100,000 people using digital banking for the first time this year.

Digital transactions by those between 50 and 64 years old rose 40 per cent from last year, while those for customers above the age of 64 increased 48 per cent.

Managed by the Government Technology Agency (GovTech), SingPass allows users to transact with more than 60 government agencies. More than 1.6 million people use it to access e-services such as checking their CPF balances, filing taxes and applying for public housing.

The app is also now widely used for SafeEntry logins at public places to facilitate contact tracing in the case of a COVID-19 outbreak.

Mr Aditya Gupta, OCBC’s head of digital business for Singapore and Malaysia, said: “I believe that offering SingPass – a trusted and widely used mode of digital authentication in Singapore – as an alternate login, will give more of our customers the confidence and convenience to bank with us digitally.”